SaaS Dilemma: Buy or Build?

August 16, 2024

Which one is the best path for your digital transformation?

Modern, cloud-based digital technology is essential for financial institutions aiming to boost internal operational efficiency, streamline communications, and ensure seamless access to data across the enterprise. Traditionally, the only option was to develop online payment security solutions in-house, requiring significant investment and resource allocation. Nowadays, banks and financial institutions have superior alternatives in Software as a Service (SaaS): purchasing technology that allows quick deployment, reduces costs, and eases the in-house burden, especially when managing ongoing maintenance.

This article explores how the landscape of online payment has changed over the last 5-10 years, showing why outsourcing technology is often the wiser choice. We will share insights from various financial institutions we have worked with over the years. Additionally, we offer a practical guide to transforming your system to a more modern setting. We'll also examine how these decisions impact the most crucial area: online payment security.

The SaaS Breakthrough

A key trend in digital transformation is the shift from on-premises systems to cloud-based solutions. In the past, our data were stored predominantly on hard drives, but now we use cloud services like Google Drive, OneDrive, and iCloud. Cloud storage is scalable and cost-effective because it's shared with many users worldwide. Moreover, it's very convenient—users can access these services from various devices, including smartphones, making managing and storing files from anywhere more accessible.

Similarly, in 1999, Salesforce led a major shift in the software industry, launching its Customer Relationship Management (CRM) platform on cloud services, more known as the SaaS (Software as a Service) model. Initially designed for startups and small businesses to share software host/ hosting and reduce costs, SaaS was met with skepticism. However, as technology and the internet improved rapidly, SaaS proved flexible, affordable, and reliable.

The Challenge of Digital Transformation

Today, SaaS has become the go-to option for almost every business need, from startups to large enterprises across various industries. This shift is part of a broader phenomenon known as digital transformation, where businesses modernize and implement cloud-based technology to stay competitive.

However, digital transformation presents unique challenges for more established sectors like banking and financial institutions. These industries handle sensitive payment data globally, which makes them more considerate about adopting new technology. The stakes are high; any misstep could have significant consequences, and deciding to develop solutions internally or purchase ready-made ones is even more critical.

Big banks often prefer in-house development to maintain first-party handling, while smaller institutions tend to outsource when possible. Mid-sized institutions are caught in the middle, struggling with outdated systems and limited resources, making it hard to move quickly. They are often attached to legacy architectures and a technology stack that is becoming rapidly obsolete. Moreover, limited access to financial, technical, and human resources further hampers their ability to achieve digital transformation swiftly and effectively.

The Hidden Cost of In-house Development

Building technology in-house might initially seem like a good idea. Still, it comes with several hidden costs that can quickly add up.

1. Over-Budget

According to Harvard Business Review, In-house development needs to be more balanced with certainty. A Harvard study of around 1,500 IT projects revealed that 27% went over budget, with some exceeding costs by 200% and timelines by 70%.

2. Developing & Hiring Talent

Finding and nurturing talent is time-consuming and challenging, especially outside tech hubs like Silicon Valley. Developing new solutions may require companies to seek specialized talent, build new teams, or reassign existing staff. This lack of immediate access to a deep talent pool can slow down processes, delay project timelines, and increase operational costs, further complicating the execution of digital transformation initiatives.

3. Building Anti-Fragile Foundation

Building a solid technological foundation is like constructing a house—you need a strong base before adding the walls, roof, or doors. In banking, developing the necessary infrastructure can take considerable time and resources, often requiring years before the system is fully functional and secure. Even once the system is up and running, ongoing attention is required to manage issues, address problems, and adapt to inevitable changes, ensuring the foundation remains effective and becomes anti-fragile, growing stronger in the face of challenges.

4. Rapid Obsolescence

Technology evolves rapidly, and in-house systems can quickly become outdated. As soon as a system is live, new demands and innovations emerge, requiring constant updates. This leads to ongoing depreciation and endless development cycles, making it difficult to stay agile. Outsourcing, by contrast, offers more flexibility without the long-term attachment to outdated systems.

5. The Luxury of Innovation

Developing new technology in-house is challenging and expensive. Success is not guaranteed, and the opportunity cost can be high. Focusing on internal development often means diverting attention and resources from the core business and competitive advantages, potentially leading to lost opportunities in other areas.

The Benefit of Buying Solutions

On the other hand, buying technology solutions offers many benefits in the short (less than a year) and long run (over two years).

Short Run Benefit

It offers a higher return on investment (ROI) and faster implementation than developing in-house. This allows for quick deployment with access to the latest technology, avoiding the delays and uncertainties associated with internal development. Additionally, many global solutions require certifications that can complicate and increase the cost of in-house development, making the process even more time-consuming and expensive for the firm.

Long Run Benefit

In the long run, this approach supports scalable growth and creates a sustainable business model. It saves time, money, and resources by reducing the need for ongoing maintenance and updates. According to Mambu, cloud solutions can save up to 50%, and Forrester reports that human capital costs make up 70% of expenses. These savings accumulate over time, providing lasting financial benefits.

For example, companies like PayPal and Square have pursued vertical mergers by acquiring or merging with their technology providers in the payment industry. Initially, these companies outsourced certain services to meet their needs. However, as their business volume increased, they found it more efficient to acquire their suppliers rather than developing similar solutions in-house. This strategy allowed them to fully integrate the technology into their operations, ensuring continuous innovation and better alignment with their long-term objectives.

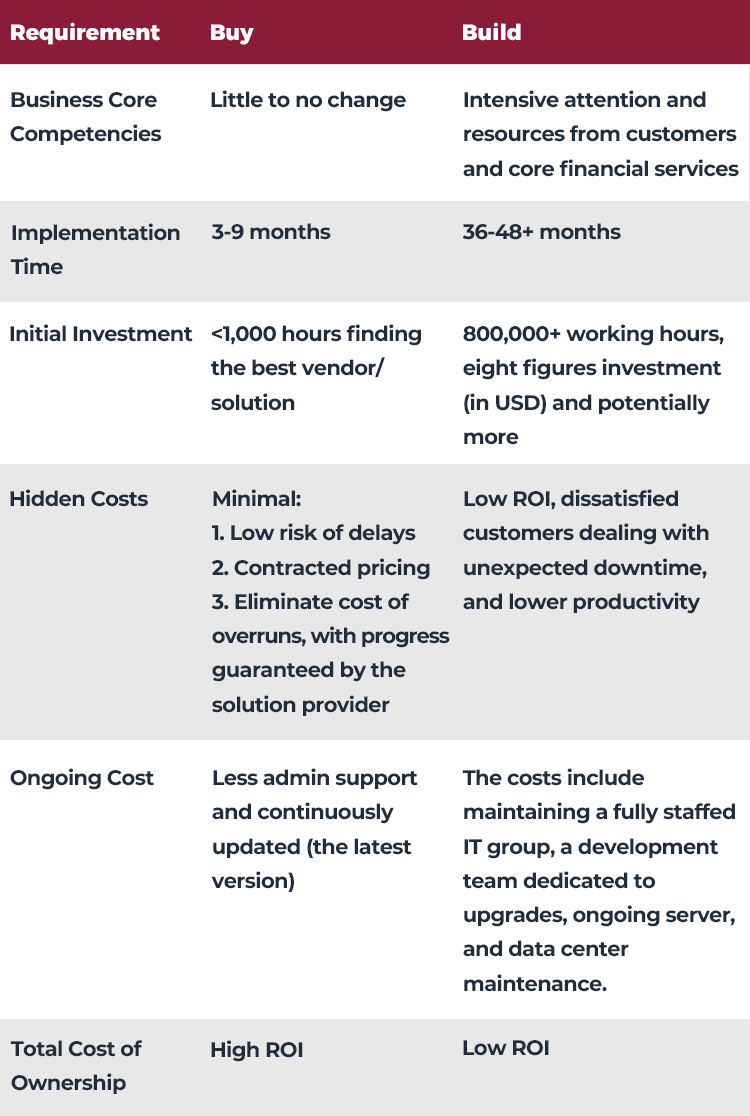

Buy Vs. Build

| Requirement | Buy | Build |

|---|---|---|

| Business Core Competencies | Little to no change | Intensive attention and resources from customers and core financial services |

| Implementation Time | 3-9 months | 36-48+ months |

| Initial Investment | <1,000 hours finding the best vendor/ solution | 800,000+ working hours, eight figures investment (in USD) and potentially more |

| Hidden Costs | Minimal: 1. Low risk of delays 2. Contracted pricing 3. Eliminate cost of overruns, with progress guaranteed by the solution provider |

Low ROI, dissatisfied customers dealing with unexpected downtime, and lower productivity |

| Ongoing Costs | Less admin support and continuously updated (the latest version) | The costs include maintaining a fully staffed IT group, a development team dedicated to upgrades, ongoing server, and data center maintenance. |

| Total Cost of Ownership | High ROI | Low ROI |

What Do You Choose: Buy or Build?

While both in-house development and outsourcing have benefits, a hybrid approach often works best. By combining the strengths of both strategies, banks and financial institutions can achieve optimal results.

For example, businesses can purchase secure, robust, and reliable foundational systems while concentrating their in-house efforts on developing front-end interfaces. This approach enables them to create a superior user experience tailored to their specific needs while providing their renowned services and products to customers, just as they have for years. By leveraging the security and scalability of established foundational solutions, businesses can maintain their core competencies: focus on what they do best.

This approach enables businesses to concentrate on their core competencies, such as customer service and financial management, while maximizing their ROI. By reducing the resources required for back-end development, they can allocate more time and capital to areas where they can truly differentiate themselves, ultimately driving innovation and growth.

Road map for An Effective Buying Strategy

To implement this hybrid approach effectively, start by setting clear, SMART goals that align with business strategy. Consider involving system integrators early to help shape your strategy with their expert insights. Once the plan is in place, start with a Minimum Viable Product (MVP) to generate quick wins. This will build confidence in the outsourced solutions while giving you room to scale up as you enhance functionality over time.

As new technologies are considered, closely examining existing processes is essential. Identifying what works well and where improvements are needed will be key in selecting the right vendor. Businesses should prioritize partners with deep industry expertise, real-time data insights, comprehensive analysis, and seamless integration..

With 25 years of experience securing online payment transactions, HiTRUST offers solutions that are fully compliant with global standards such as EMV, W3C, and FIDO. While adhering to these standards, there is flexibility for customization to meet specific requirements. This includes support for local languages, compliance with local card schemes in 3-D Secure, tailored AI fraud detection rule engines, and adaptable integration methods.

Moreover, effective training and clear communication are critical to successful implementation. HiTRUST collaborates with local experts, such as VinCSS in Vietnam, to deliver reliable, market-specific solutions. With strong proficiency in both Chinese and English, HiTRUST ensures clear, responsive support that facilitates smooth deployment and compliance across diverse regions. Additionally, HiTRUST provides ready-to-use regional cloud services in the US, Taiwan, China, Singapore, and Vietnam, offering fast, secure access tailored to the unique needs of each market.

Conclusion: Buy > Build?

In today's fast-paced environment, buying technology solutions outweighs the benefits of building in-house. With quicker implementation, cost savings, and access to the latest innovations, buying allows financial institutions to stay competitive without the risks and hidden costs of in-house development.

Ready to elevate your digital transformation? Connect with HiTRUST today and discover how our expert solutions can drive your success