Let's meet the novel member in Visa family — DAF!

February 10, 2022

Visa is introducing Digital Authentication Framework (DAF)

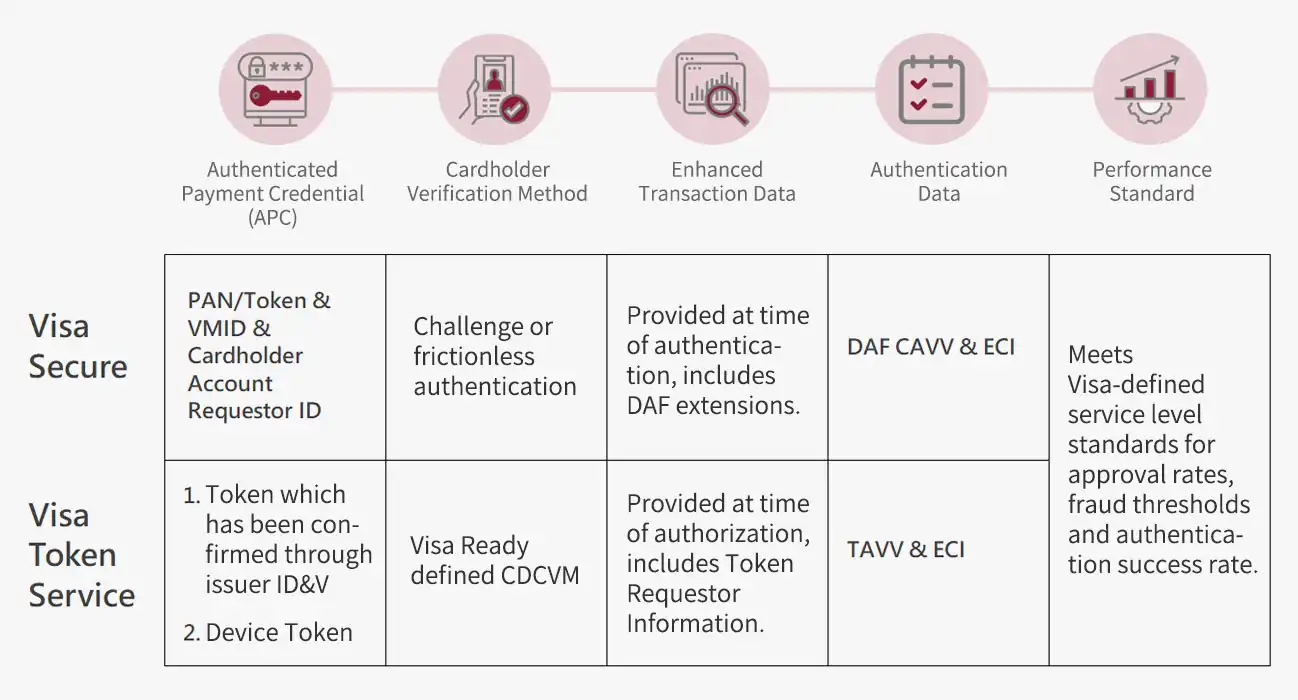

Digital Authentication Framework (DAF) is first introduced by Visa in 2021. The main purpose of DAF is to have Card-Not-Present (CNP) transactions with higher approval rates, lower fraud and a consistent consumer experience with low to no friction, comparable to a face-to-face contactless card transaction. DAF can be applied to Visa Secure and Visa Token Service (VTS). Merchant who is interested in joining the DAF program can apply in April 2022, and Visa requires issuers to fully support it in April 2023.

*Out of Scope:Issuers and acquirers in Japan and India, issuers in US and Canada will not support DAF.

Increase frictionless

authentication

Prevent fraud

Improve user experience

DAF's five elements

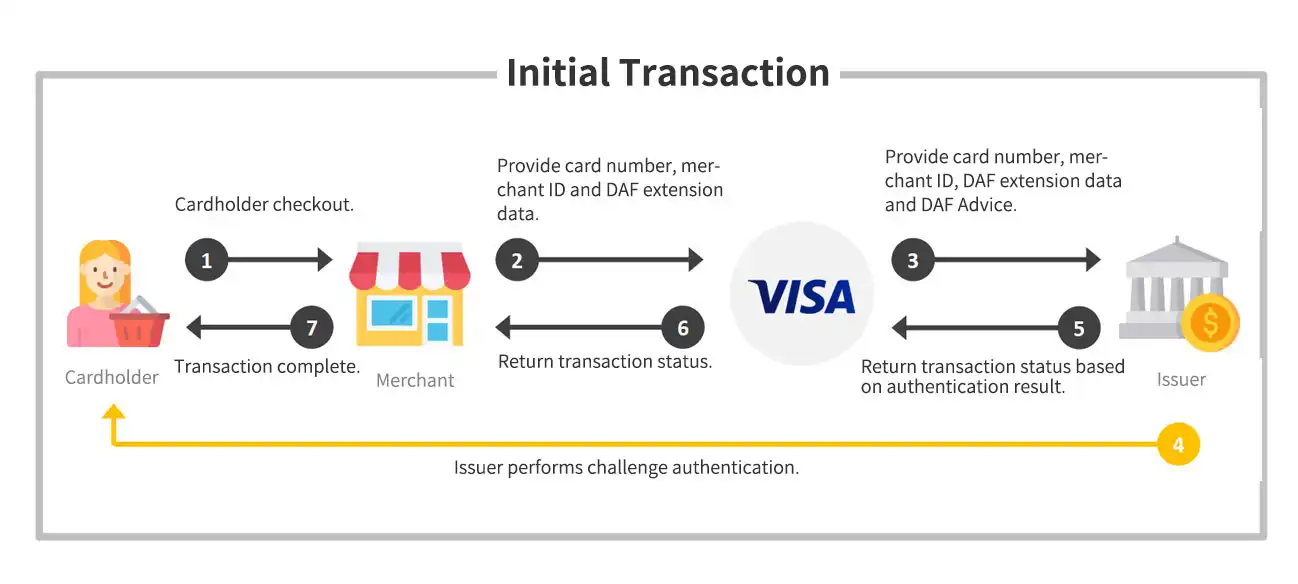

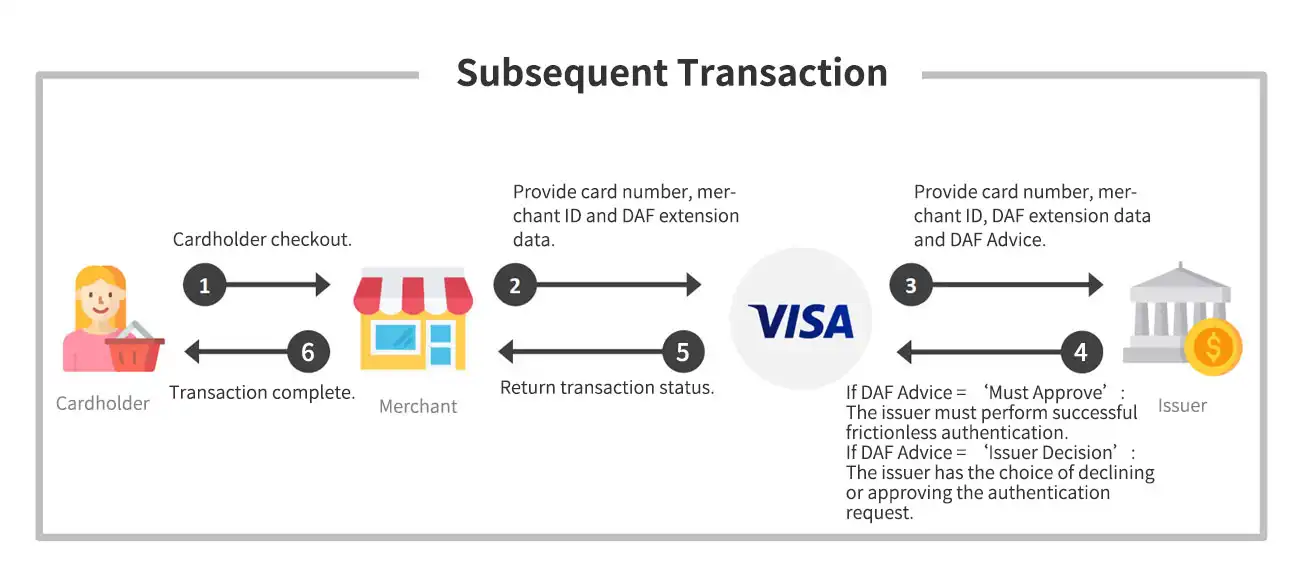

Increase Frictionless Authentication

The purpose of DAF is to increase frictionless rate. Therefore, only the first transaction the issuer can perform challenge authentication to confirm the identity of the cardholder. For the subsequent transactions with the same card number and same merchant, the issuer must perform successful frictionless authentication of the cardholder. If transaction is advised by Visa that it is up to issuer's decision, then the issuer has the choice of declining or approving the authentication request. Under no circumstances should the issuer require a challenge for a registered APC. If issuer fails to comply with requirement of DAF advise, Visa will step in and return transaction approval message to the merchant, and the issuer is liable for fraud. Merchants participating in DAF program will be able to streamline their shopping experience while obtain fraud liability shift.