How Machine Learning Works in Fraud Prevention

August 15, 2023

Introduction

In the rapidly advancing digital landscape, online environments pose significant threats, particularly in terms of fraud. To combat these risks, machine learning (ML) has emerged as a powerful tool in fraud detection. ML techniques are being deployed in various sectors, including banks and financial institutions for transaction security, e-commerce platforms for login and payment authentication, and other applications.

Defining machine learning (ML)

Machine learning refers to the ability of computer systems to learn and improve from data without explicit programming. It involves training algorithms to recognize patterns, make predictions, and identify anomalies. ML finds applications across different industries, such as healthcare, marketing, autonomous vehicles, and recommendation systems, showcasing its versatility and effectiveness.

Why machine learning (ML) models are adopted in fraud detection

ML models offer several advantages over traditional rules-based fraud detection methods. This is because simple rules-based approaches are often rigid, requiring manual updates to accommodate changes in circumstances and people's behaviors. Moreover, they are rather time-consuming and demand significant human effort to continuously maintain, often lacking the capacity to respond instantaneously. ML models, on the other hand, provide timely and more detailed analysis based on large volumes of transactional data, allowing for improved fraud detection accuracy.

How machine learning works in fraud detection

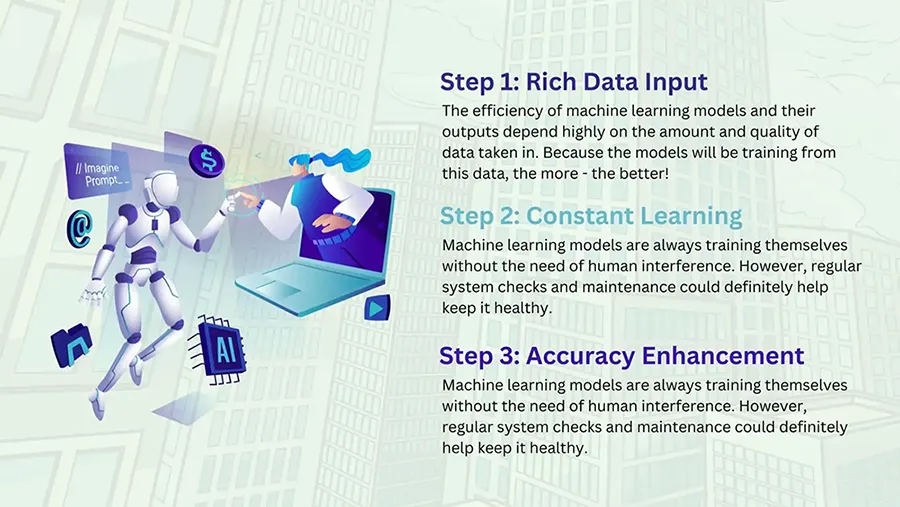

While ML applies widely into different industries, its way in fraud detection can be divided into three basic steps.

Data Input:

ML models require substantial volumes of data to learn and train themselves effectively without much interference from humans. The finance and banking industry, with its daily processing and generation of large amounts of data, is particularly well-suited for ML implementation.

Within this data, algorithms can be designed to identify and extract features—detailed information and intelligence that can be derived from raw data. Both numerical and non-numerical data can be utilized to gain insights and analyze transaction behaviors. To sum up, the more information is fed to the ML model, the more accurate analyses are leading to automated decision-making.

Weighing features within the Model:

Most of the time, historical data is the most important contribution to machine learning model training. This training process helps determine whether a specific feature represents normal or abnormal behavior. By analyzing the data, the model can reveal insights that differentiate between genuine and fraudulent behaviors.

For instance, if the model has identified that transactions equal to or exceeding $10,000 have a 20% fraudulent occurrence rate based on historical data, this information can be factored into the model's prediction of suspicious transactions. The prioritization of specific features can be customized based on industry requirements and specific needs to unveil hidden risks and tackle them.

Learning and improving performance:

ML models continuously learn and improve their predictive accuracy through a process of trial and error. As more data is fed into the model, it gains insights and refines its predictions, achieving greater efficiency over time.

Conclusion

In the ever-evolving landscape of online payments, technology plays a crucial role in enhancing both efficiency and accuracy. By integrating machine learning into fraud management programs, organizations can automate and continuously improve their detection mechanisms without relying solely on a large labor force.

While complex transactions still require humans to make decisions upon, ML models bring along the ability to flexibly adapt and improve itself over time, in accordance with environmental and behavioral changes. More than that, they lift the burden on the shoulders of your team and allow them to prioritize high-level risk management tasks that are more on the strategic side.

Exploring the potential of new technologies in fraud management is essential for staying one step ahead in the ongoing fight against fraud. Embrace the power of machine learning in fraud prevention to safeguard your business and customers effectively.