Embracing the Future of Security: FIDO2 and Passkeys in the Financial Sector

January 12, 2024

In an era where digital security is vital, the banking and financial industries are witnessing a revolutionary shift towards more robust and user-friendly authentication methods. Central to this transformation are Passkeys and FIDO2, technologies that are redefining how we secure our digital lives from the growing threats.

In this article, we will be discussing FIDO2, Passkeys, and their impact on securing digital identities while enhancing the user journey on online platforms.

What is FIDO2?

FIDO2, succeeding FIDO, is the global authentication standard put forth by the FIDO Alliance used in passwordless authentication. The main objective of FIDO2 is to facilitate the elimination of legacy password systems that pose growing phishing and man-in-the-middle threats in the digital world.

Originally, this technology was available through hardware tokens, where the private key was securely stored. However, to enhance user-friendliness and address the cumbersome nature of the said tokens, companies like Apple, Microsoft, and Google have developed new standards to streamline the password management process, substituting them with soft tokens, with the support of biometric authentication.

Understanding Passkeys: A Leap in Digital Security

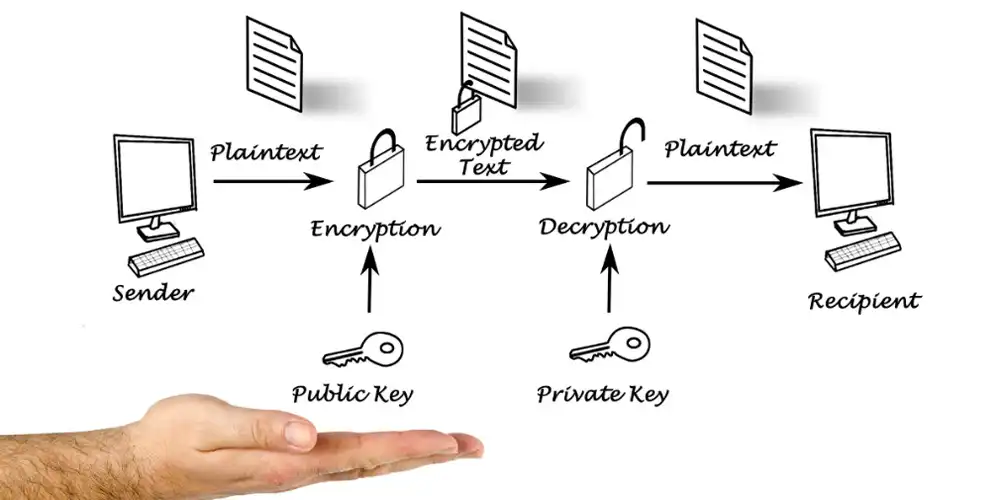

Passkeys represent a consumer-friendly adaptation of the FIDO2 and WebAuthn global security standards. Since their inception around 2017, tech giants like Google, Microsoft, and Apple have been rapid to adopt this advanced authentication technology. Unlike traditional time-based one-time passcode (TOTP) systems, Passkeys employ a more secure approach, leveraging biometric authentication methods familiar to many users. This approach is safer because the private and public keys, essential for encryption and decryption, are unique and cannot be replicated or matched in any different way. Additionally, these keys do not leave their respective storage location during authentication, which in turn further enhance security.

Why Passkeys Matter More Than Ever

In a world where non-technical individuals, including children and the elderly, are increasingly vulnerable to fraud through hacking and phishing, robust security measures are crucial. Weak passwords contribute to a significant portion of all hacking-related breaches. According to Digital Shadows, in 2022 alone, over 24 billion passwords were exposed and shared among hackers, highlighting the urgency for stronger security solutions like Passkeys.

For instance, Apple's iCloud Keychain, allows Passkeys to be stored more conveniently, offering cross-platform accessibility and an enhanced user-experience. Users can seamlessly authenticate across different devices, sharing their Passkeys with devices under the same iCloud account.

The Challenge for Banking and Financial Institutions

While Passkeys offer convenience, they also present new challenges for the banking and financial sectors. The ease of access could potentially lead to reduced security and increased risks. Recognizing the inevitability of adopting FIDO standards, many financial institutions around the world are leaning towards FIDO2 as an alternative for traditional username and password systems.

This preference stems from FIDO2's device-bound private keys, which are stored exclusively on the user's device rather than any public server. This approach is inherently safer, though it sacrifices some of the convenience offered by Passkeys, such as not being able to utilize the same passkey on different Apple devices under the same iCloud.

Conclusion: Preparing for a Digital Transformation

The integration of FIDO2 and Passkeys marks a significant step in the digital transformation journey of the global banking sector. As these technologies become more prevalent, they are on the way to offer an optimal balance between convenience and heightened security.

As a provider of payment security solutions, we find that financial institutions looking to stay ahead in this evolving landscape must consider embracing these innovations. For those ready to implement FIDO2 and explore how these technologies can enhance your security infrastructure, we invite you to contact us for expert guidance and detailed consultation. Embrace the future of financial security today.