Assessing risk levels

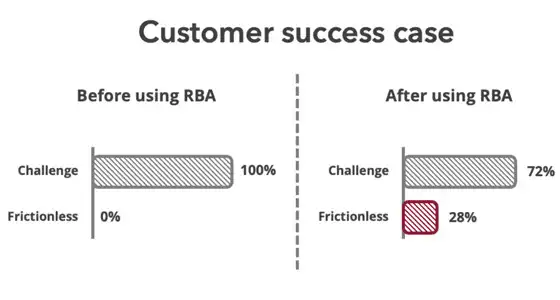

As an advanced security mechanism, RBA assesses the level of risk associated with a particular transaction or user activity by leveraging various factors such as user behavior, device information, and historical data. Through the analyses, RBA systems assign a risk score to each transaction, allowing organizations to implement appropriate security measures based on the level of risk identified.