Unveil Fraud From Device Fingerprints

Our cutting-edge Fraud Detection System captures up to 100 device attributes, ensuring utmost security without added friction.

Our cutting-edge Fraud Detection System captures up to 100 device attributes, ensuring utmost security without added friction.

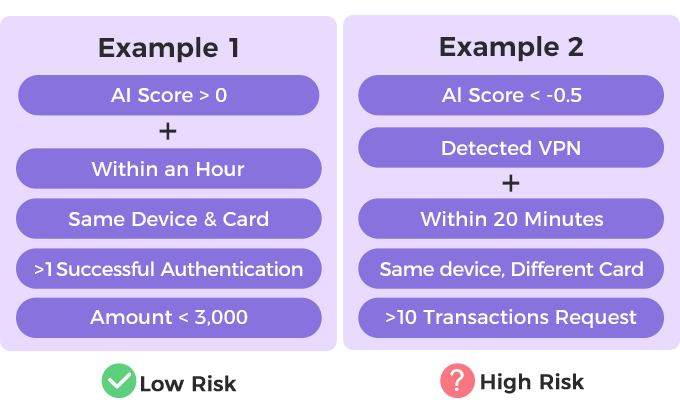

Veri-id combines device information, transaction, and historical data for comprehensive Risk Scoring using AI. The Rule Engine component categorizes customer activities into low, medium, or high risk, ensuring secure and frictionless user experiences.

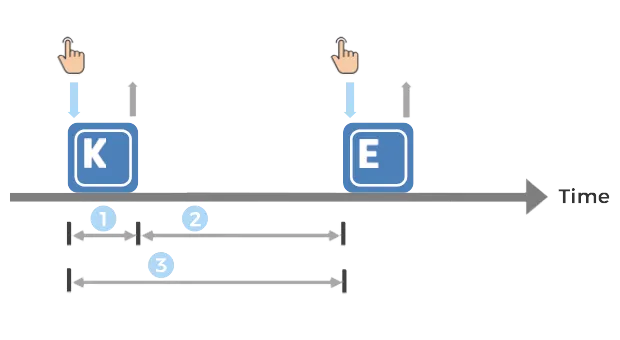

Advanced Bot Detection analyzes typing patterns through time intervals between key presses, typing dynamics, distinct motions, and more.

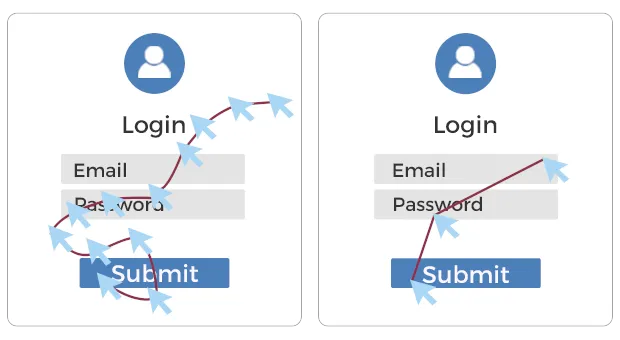

Advanced bot detection identifies robotic movements, which are typically faster and more rigid, with fewer and sharper turns, distinguishing them from human-like mouse movements.

Rule Engine empowers you to define and customize risk rules for any scenario. Categorize each use case to accurately assess your current risk levels.

Identify and mitigate fraudulent transactions with pinpoint accuracy.

Boost 3-D Secure success rates with increased frictionless transactions.

Understand and recognize genuine customers through their behavior.

Identify good and bad transactions to protect merchants and prevent unwanted chargebacks.

Elevate security by instantly approving or rejecting transactions, perfectly complementing 3-D Secure.

As per Visa's regulations, device information collected during transactions can be used as proof against unwanted chargebacks.

Spot 'potential' fraud and reduce unwanted chargebacks to protect your platform.

Protect merchants by swiftly identifying and spotting fraudulent or malicious orders before they ship.

As per Visa's regulations, device information collected during transactions can be used as proof against unwanted chargebacks.